Kiran Negi

Member Info

-

Profile Type: Regular Member

-

Profile Views: 126 views

-

Friends: 0 friends

-

Last Update: Thu at 11:49 PM

-

Last Login: Thu at 11:31 PM

-

Joined: December 15, 2025

-

Member Level: Default Level

Updates

Nothing has been posted here yet - be the first!

Info

Personal Information

- First Name Kiran

- Last Name Negi

- Gender Female

- Birthday January 1, 2000

Contact Information

Personal Details

- About Me In search of immediate financial support? Our Instant Personal Loan options are made to fit any need and can be approved quickly. You can apply for a Personal Loan online in minutes, and the process is easy and requires no paperwork. You can get a Cash Loan, an Instant Loan, or apply for a Personal Loan right away. We offer safe and reliable choices to help you deal with emergencies or planned costs. Instant Loan Online services make getting money easy, and you have a lot of different ways to pay them back. The Personal Loan Apply Online process is easy, and you can get your money quickly if you apply now.

Forum Posts

-

- Kiran Negi

- 5 posts

Posted in the topic Brief History of Urban Cooperative Banks in India – An InvestKraft Guide in the forum SupportJanuary 29, 2026 11:49 PM PSTUrban cooperative banks have played an important role in India’s banking ecosystem, especially for small businesses, salaried individuals, and local communities. Below is a detailed forum-style discussion to help you understand cooperative banks in India, their evolution, benefits, risks, and recent updates.

Top 10 Co-operative Banks in India 2025–2026 (With Customer Care Numbers)

Urban cooperative banks operate mainly in cities and towns, offering retail banking services. Some of the best cooperative banks in India for 2025–2026 include well-known names such as Saraswat Cooperative Bank, Cosmos Bank, Shamrao Vithal Cooperative Bank, Abhyudaya Cooperative Bank, and Punjab & Maharashtra Cooperative Bank. These banks continue to improve digital services and customer support, making them competitive with regular banks.

What is a Co-operative Bank?

A cooperative bank is a financial institution owned and managed by its members. Unlike commercial banks, cooperative banks operate on the principle of mutual help. Profits are either reinvested or shared among members. Urban cooperative banks mainly serve individuals, small traders, and local businesses in urban areas.

List of Top Co-operative Banks in India 2025–2026

The co-operative banks list 2026 includes both multi-state and state-level urban cooperative banks. Leading examples include Saraswat Bank, Cosmos Bank, Abhyudaya Bank, TJSB Sahakari Bank, and NKGSB Cooperative Bank. These institutions offer savings accounts, fixed deposits, loans, and digital banking services.

Key Updates in 2025–2026 for Co-operative Banks

Recent co-operative bank updates 2025 include stronger RBI supervision, improved compliance rules, and a greater focus on digital banking. Many cooperative banks have adopted UPI, mobile banking apps, and core banking systems to improve transparency and customer trust.

Difference Between Co-operative Bank, Regular Bank, and Other Bank Types

Cooperative banks differ from regular banks mainly in ownership and governance. While commercial banks are profit-driven and owned by shareholders, cooperative banks are member-owned. NBFCs, on the other hand, focus on lending and do not offer full banking services like savings accounts.

Benefits of Banking with Co-operative Banks

Some major co-operative bank benefits include personalized customer service, competitive interest rates, easier loan approval for local customers, and community-focused operations. These cooperative bank features make them ideal for small borrowers and senior citizens.

Challenges and Risks Involved with Co-operative Banks

Despite their benefits, cooperative banks face challenges such as limited capital, governance issues, and slower expansion. Customers should always check RBI guidelines, deposit insurance coverage, and the bank’s financial health before opening accounts or deposits.

Final Thought:

Urban cooperative banks remain an essential part of India’s financial system. With regulatory improvements and digital upgrades, many top cooperative banks 2025–2026 are becoming safer and more customer-friendly. Platforms like InvestKraft help users stay updated and make informed banking decisions.

-

- Kiran Negi

- 5 posts

Posted in the topic Aditya Birla Capital Life Insurance Achieve Excellence at Insurance Asia Awards in the forum SupportJanuary 22, 2026 10:24 PM PSTAditya Birla Capital Life Insurance Achieve Excellence at Insurance Asia Awards

Aditya Birla Capital Life Insurance has once again strengthened its position as one of India’s most trusted life insurers by achieving excellence at the prestigious Insurance Asia Awards. This recognition underscores the company’s steadfast commitment to innovation, customer-centric solutions, and long-term financial security for Indian families. For investors and policyholders alike, this award reinforces confidence in Life Insurance Aditya Birla Capital as a reliable and future-ready insurance provider.

Why the Insurance Asia Awards Matter

The Insurance Asia Awards are among the most respected accolades in the insurance industry across Asia. These awards evaluate insurers on parameters such as product innovation, customer service, digital transformation, and overall business performance.

For Aditya Birla Capital Life Insurance, winning at this platform reflects its ability to deliver value-driven insurance solutions consistently. Often referred to by customers as Birla Life Insurance or Aditya Life Insurance, the brand has successfully adapted to evolving customer needs while maintaining transparency and trust. This recognition also places it alongside leading global insurers, showcasing its competitive strength in the Asian insurance market.

Strong Product Portfolio and Customer Trust

One of the key reasons behind this achievement is the company’s diversified range of life insurance products. From term insurance and ULIPs to savings, retirement, and protection plans, Aditya Sun Life Insurance (commonly used by customers searching online) has something for every life stage.

The company focuses on:

- · Long-term financial security

- · Flexible premium options

- · Digital policy management

- · Simple claim settlement processes

This customer-first approach has helped Aditya Birla Capital Life Insurance build long-lasting relationships and high retention rates. Platforms like Invest Kraft also highlight the insurer as a preferred choice for individuals looking to combine protection with disciplined financial planning.

What This Award Means for Policyholders and Investors

For existing policyholders, this award serves as reassurance that they are associated with a financially strong and well-governed insurer. It validates the company’s operational excellence and ethical business practices.

For new buyers and investors researching Life Insurance Aditya Birla Capital, the Insurance Asia Award acts as a trust signal. It indicates that the company not only meets regulatory standards but also excels beyond them. Whether you are planning for family protection, wealth creation, or retirement, choosing an award-winning insurer can make a meaningful difference in your long-term financial journey.

Final Thoughts

The recognition of Aditya Birla Capital Life Insurance at the Insurance Asia Awards is a proud milestone for the brand and its customers. It reflects years of innovation, customer focus, and financial discipline. As the life insurance sector continues to evolve, Birla Life Insurance remains well-positioned to lead with integrity, technology, and value-driven solutions.

For anyone exploring reliable life insurance options or researching through platforms like Invest Kraft, this achievement makes Aditya Birla Capital Life Insurance a name worth considering.

-

- Kiran Negi

- 5 posts

Posted in the topic Top Child Insurance Plans for Education Security and Long-Term Growth in the forum SupportJanuary 20, 2026 11:23 PM PSTThe HDFC Life Insurance Plans List covers options for salaried professionals, self-employed individuals, business owners, and retirees. This wide product portfolio makes HDFC Life a preferred insurer for long-term financial planning.

Digital Access and Transparency

HDFC Life emphasizes transparency and ease of access. Customers can review HDFC Life insurance policy details, policy brochures, and premium calculators online. This digital-first approach ensures clarity before purchasing any HDFC Insurance Policy.

Awards and Achievement

Awards and recognitions play a crucial role in establishing trust in an insurance company. HDFC Life has received multiple prestigious awards for innovation, customer experience, and digital transformation, reinforcing its leadership position in the insurance industry.

12th Golden Globe Tigers Awards

At the 12th Golden Globe Tigers Awards, HDFC Life was recognized for excellence in insurance services and leadership. This award highlights the company’s consistent focus on innovation, strong governance, and customer satisfaction.

15th Edition of the CX Strategy Summit and Awards 2024

HDFC Life received recognition at the 15th CX Strategy Summit and Awards 2024 for delivering superior customer experience. The award reflects the insurer’s commitment to seamless onboarding, policy servicing, and claims support through digital platforms.

16th Mint BFSI Summit and Awards

The 16th Mint BFSI Summit and Awards honored HDFC Life for its contribution to India’s financial services ecosystem. The award acknowledges its role in strengthening insurance awareness and offering customer-friendly HDFC Life Insurance Plans.

17th Customer Fest Leadership Awards 2024

At the 17th Customer Fest Leadership Awards 2024, HDFC Life was applauded for its leadership in customer engagement and service excellence. This achievement reflects the company’s focus on long-term relationships and policyholder trust.

3rd Future of Insurance Summit and Awards 2024

The 3rd Future of Insurance Summit and Awards 2024 recognized HDFC Life for adopting future-ready technologies. The company’s digital tools help customers easily understand HDFC Life policy benefits and manage insurance efficiently.

4th Smart CX Summit and Awards 2024

HDFC Life’s recognition at the 4th Smart CX Summit and Awards 2024 highlights its innovative approach to customer interaction. Advanced analytics, AI-driven support, and digital servicing set the company apart in the insurance space.

6th CX Transformation Confex and Awards 2024

At the 6th CX Transformation Confex and Awards 2024, HDFC Life was acknowledged for transforming customer journeys. From policy purchase to claims settlement, the company ensures simplicity, speed, and transparency.

6th Digital Customer Experience Awards

Winning the 6th Digital Customer Experience Awards further strengthens HDFC Life’s reputation as a tech-driven insurer. Digital tools make it easy for customers to explore the HDFC Life Insurance Plans List and understand policy features online.

7th Annual Insurance Conclave and Awards

The 7th Annual Insurance Conclave and Awards honoured HDFC Life for its contribution to insurance innovation and customer trust. This recognition reinforces the company’s commitment to offering reliable and flexible insurance solutions.

Conclusion

While customers often search for ways to check policy status online without registration, understanding the strength and credibility of an insurer is equally important. HDFC Life stands out due to its diverse product portfolio, transparent insurance policy structure, and numerous industry awards.

With a strong digital presence, customer-focused services, and recognition across multiple platforms, HDFC Life Insurance Plans continue to be a trusted choice for individuals planning long-term financial security. Platforms like Invest Kraft further help customers compare and choose the right HDFC Life policy with confidence.

-

- Kiran Negi

- 5 posts

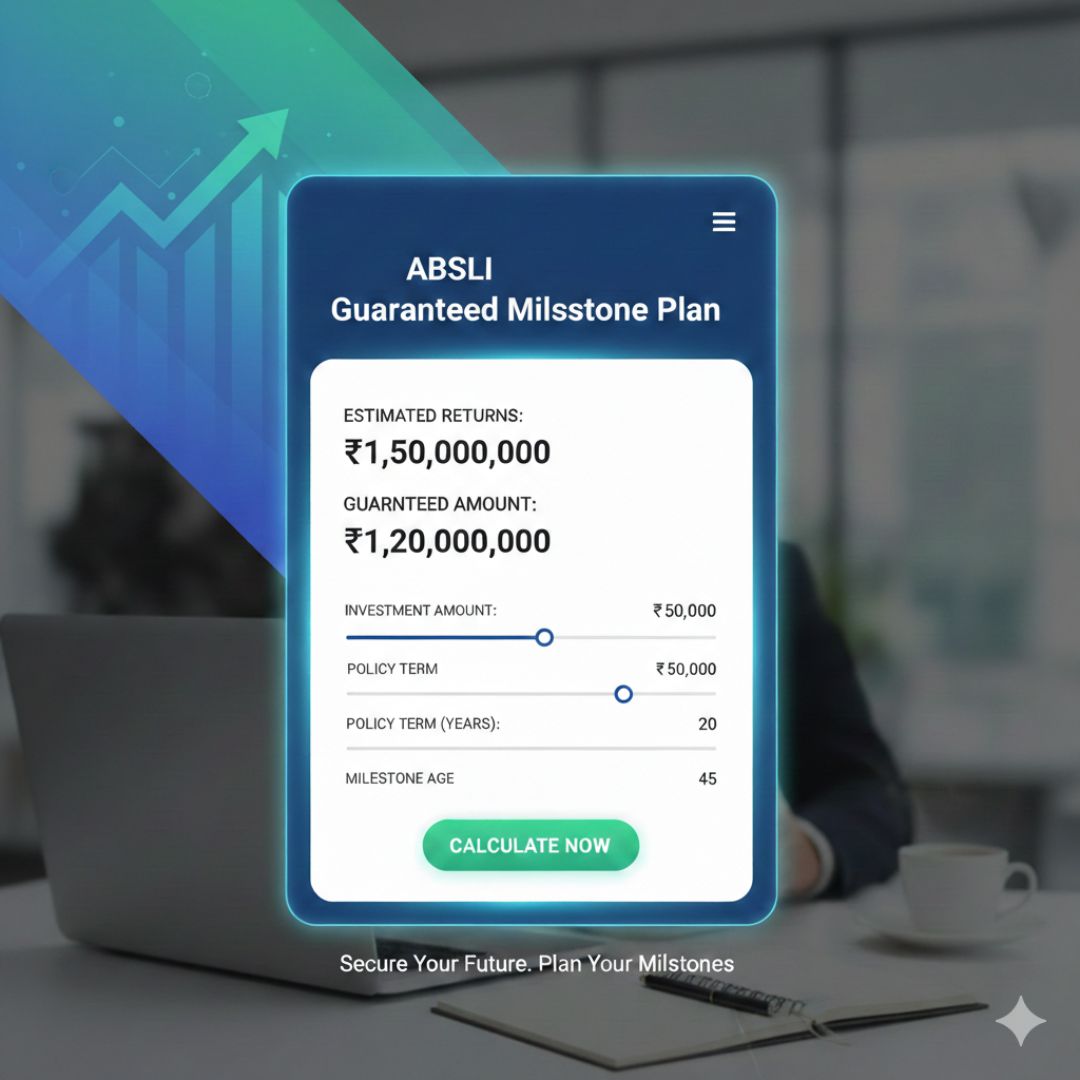

Posted in the topic ABSLI Guaranteed Milestone Plan Returns Calculator | Check Maturity Online in the forum SupportJanuary 16, 2026 3:27 AM PSTThe ABSLI Guaranteed Milestone Plan is attracting the notice of those investors seeking reliable returns and guaranteed protection along with a life insurance cover. Using the online returns calculator tool allows one to quickly assess the returns at the point of maturity, survival payouts, and future values before actually investing. This piece dismantles the proceedings of the online return calculator and its alignment with your own financial objectives.

What Is Aditya Birla GMP (Guaranteed Milestone?

Aditya Birla GMP, which is also known as ABSLI Guaranteed Milestone Plan, comes under the non-linked, non-participating life insurance plans. It has been designed in such a way that it provides assured benefits in the form of payouts at predefined milestones, thereby making it an investment option for conservative funds.

Guaranteed survival benefits, maturity benefits, and providing economic security to your loved ones in unforeseen circumstances.

How the ABSLI Guaranteed Milestone Plan Calculator Functions

ABSLI-GUARANTEED MILESTONE PLAN RETURNS CALCULATOR:

The ABSLI Guaranteed Milestone Plan Returns Calculator is a computer-based software application that calculates

1. Age of the Policyholder

2. Premium amount and payment term

3. Term of policy

Payout option selected All this information is used by the calculator to provide the Guaranteed Milestone Payoffs and Maturity Value so that you can get an idea about the returns before investing.

Benefits of the Online Maturity Calculator: An online maturity calculator

More clarity on future planning

It is very easy to project what kind of payments are to be expected down the line using a calculator so that you can plan for your future objectives relating to education costs, retirement planning, or simply wealth preservation.

Save time, see clearly

No more doing math calculations. Results are immediate, with straightforward projections of benefits.

More effective side-by-side comparisons

When you use the calculator, it is easy to compare the return guarantees offered by the Aditya Birla GMP with those offered by other funds that provide return guarantees in the market

Should you invest in the ABSLI Guaranteed Milestone Plan?

If you are looking for steady and predictable returns with insurance benefits, then the ABSLI Guaranteed Milestone Plan will suit you. They may not be ideal for those aiming for high returns; however, for conservative investors, these plans will prove a good option.

Online platforms like Invest Kraft will help you understand the features of the plan, calculate the maturity benefit, and choose the right insurance products.

-

- Kiran Negi

- 5 posts

Posted in the topic What is the Maximum Loan Amount I Can Get Instantly? in the forum SupportDecember 26, 2025 4:50 AM PSTInstant personal loans have become one of the fastest ways to meet urgent financial needs. If you are planning to apply for a personal loan online, the maximum loan amount you can get instantly depends on several important factors, such as income, credit score, employment type, and lender policies. Platforms like Invest Kraft help simplify the process by connecting you with trusted lenders offering quick approvals.

Factors That Decide Your Maximum Instant Loan Amount

When you apply for a personal loan online, lenders evaluate your profile before approving the loan amount. Key factors include:

Monthly Income and Employment Stability

Higher and stable income increases your eligibility. Salaried individuals and self-employed professionals with regular earnings often qualify for higher loan amounts.

Credit Score and Repayment History

A good credit score (usually 750 or above) improves your chances of getting a higher instant loan amount at better interest rates. A clean repayment history is crucial.

Existing Financial Liabilities

If you already have active loans or EMIs, lenders may reduce the approved amount to ensure affordability.

Maximum Instant Personal Loan Amount in India

Typically, when you apply for a personal loan online, instant loan amounts range from ₹10,000 up to ₹5 lakh, depending on eligibility. Some lenders may offer higher amounts, but instant approvals are usually capped to ensure quick disbursal. With Invest Kraft, you can compare multiple lenders and find the best possible offer instantly.

How to Increase Your Instant Loan Eligibility

To get a higher loan amount instantly:

Maintain a strong credit score

Keep existing EMIs low

Apply with accurate income details

Choose a reliable platform like Invest Kraft

Final Thoughts

Knowing the maximum loan amount, you can get instantly helps you plan better. By choosing the right platform and maintaining financial discipline, personal loans online become fast, secure, and hassle-free. Start your personal loan online application journey today with Invest Kraft and get instant access to funds when you need them most.