Sagar Sharma

Member Info

-

Profile Type: Regular Member

-

Profile Views: 386 views

-

Friends: 0 friends

-

Last Update: 13 hours ago

-

Last Login: 13 hours ago

-

Joined: November 21, 2025

-

Member Level: Default Level

Updates

Nothing has been posted here yet - be the first!

Info

Personal Information

- First Name Sagar

- Last Name Sharma

- Gender Male

Contact Information

Personal Details

-

About Me

Discover the most intelligent strategy to invest in high-growth companies before they go public. You can buy and sell unlisted shares on our site in a safe and open environment. You can also look at the best pre-IPO stocks and keep up with the latest unlisted Kraft news. We make the process easy and reliable, whether you want to diversify your portfolio, explore early-stage investment opportunities, or trade private market stocks that aren't available to everyone else. If you start dealing in unlisted shares right now, you can make a lot of money before the IPO boom.

Forum Posts

-

- Sagar Sharma

- 23 posts

Posted in the topic Unlisted Shares in India: A Complete Guide to Investing and Tracking Ownership in the forum SupportJanuary 30, 2026 2:54 AM PSTInvesting in unlisted shares in India is gaining popularity among investors who want early access to high-growth companies before they get listed on the stock exchange. However, investing in unlisted companies is very different from buying listed stocks. It requires proper research, patience, and strong due diligence. In this forum post, let’s discuss how to analyse unlisted shares, understand their valuation, assess risks, and track ownership after investment.

What Are Unlisted Shares and Why Investors Are Interested?

Unlisted shares are shares of companies that are not traded on recognized stock exchanges like NSE or BSE. These companies may be startups, private firms, or pre-IPO companies planning to go public in the future. Investors are attracted to unlisted shares because they often come at lower valuations and can offer high returns if the company performs well or launches a successful IPO.

However, investing in unlisted shares is not risk-free. Liquidity is low, information is limited, and price discovery is not transparent. That’s why unlisted shares analysis is extremely important before investing.

How to Analyse Unlisted Shares in India

When learning how to analyse unlisted shares, investors should focus on both financial and qualitative factors. Start by reviewing the company’s financial statements such as revenue growth, profit margins, debt levels, and cash flow. Consistent growth and improving fundamentals are positive signs in unlisted shares analysis.

Unlisted shares' valuation is another key factor. Since these shares are not traded daily, valuation is usually based on peer comparison, recent funding rounds, book value, or future earning potential. Avoid investing blindly based on hype—always understand whether the price matches the company’s actual business strength.

Equally important is unlisted shares due diligence. Check the company’s promoters, management experience, business model, competitors, legal compliance, and long-term vision. A strong management team with a clear growth plan reduces investment risk.

Risks Involved in Investing in Unlisted Shares

Unlisted shares risks are higher compared to listed stocks. The biggest risk is liquidity—selling unlisted shares can take time, sometimes months. There is also limited public information, which makes analysis challenging. Corporate governance issues, delays in IPO plans, and regulatory changes can also impact returns.

That’s why investing in unlisted shares should only be done with surplus funds and a long-term perspective. Diversification is essential—never put all your capital into a single unlisted company.

Tracking Ownership and Holding Unlisted Shares

After investing, tracking your unlisted shares is crucial. Most unlisted shares in India are held in demat form. You can track ownership through your demat account statements, CDSL or NSDL portals, and regular company communications. Maintaining proper documentation, share transfer confirmations, and transaction records is important for future selling or IPO conversion.

Final Thoughts

Unlisted shares can be rewarding if approached with the right knowledge and discipline. Proper unlisted shares analysis, realistic valuation, awareness of risks, and thorough due diligence are the foundation of successful investing in unlisted shares. Always research deeply, consult professionals if needed, and invest with a long-term mindset.

-

- Sagar Sharma

- 23 posts

Posted in the topic Polymatech Shares Investment – Step-by-Step Guide for Unlisted & Start-Up Stocks in the forum SupportJanuary 23, 2026 1:50 AM PSTInvesting in Polymatech Electronics Ltd can be a great opportunity for those looking to explore unlisted shares and early-stage start-up investments. Polymatech, renowned for its high-quality electronics components, has been drawing interest from investors eager to enter the market ahead of its public listing. In this guide, we’ll walk you through the key aspects of investing in Polymatech shares, including fundamentals, financials, and how to access investor documents.

Polymatech Electronics Ltd Unlisted Shares

Unlisted shares, like those of Polymatech Electronics, are not yet traded on major stock exchanges. Investing in them allows early investors to potentially benefit from significant growth before the company goes public. While these shares are riskier compared to publicly listed stocks, they often provide higher returns for informed investors. If you’re looking to buy Polymatech shares, you should start by understanding the company’s business model and market potential.

Fundamentals About Polymatech Electronics Ltd

Polymatech Electronics specializes in manufacturing essential electronics components used in a variety of consumer and industrial applications. Before investing, consider these fundamentals:

· Company Profile: Polymatech has a proven track record in electronics manufacturing.

· Product Range: From semiconductors to microelectronics, the company caters to both domestic and international clients.

· Growth Potential: With a rising demand for electronics components globally, Polymatech has strong expansion prospects.

Understanding these fundamentals will help investors make informed decisions about the potential risks and rewards associated with Polymatech Electronics unlisted shares.

Downloads & Investor Documents

When investing in unlisted shares, it’s crucial to review official investor documents. Polymatech provides downloadable resources such as annual reports, financial statements, and business presentations. These documents give insight into the company’s strategy, operational efficiency, and market positioning. Ensure you access the latest files to understand the company’s performance and investment potential.

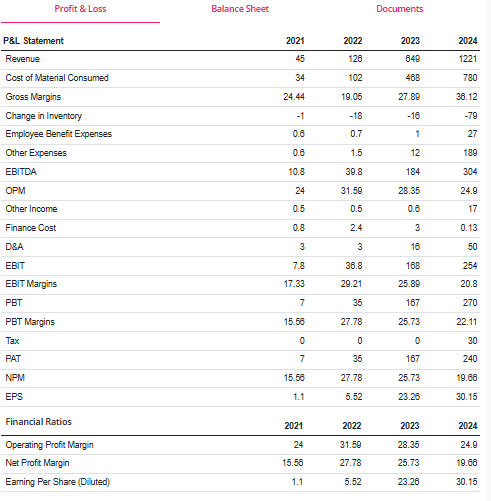

Key Financials of Polymatech Electronics Ltd

Before purchasing shares, evaluate Polymatech’s financial health. Look for:

1. Revenue Trends: Check how the company’s revenue has grown over recent years.

2. Profit Margins: Consistent profitability indicates operational efficiency.

3. Debt Levels: A manageable debt structure reduces financial risk.

Financial Ratios

Analyzing key ratios like P/E ratio, current ratio, and return on equity can help you gauge the company’s performance compared to industry benchmarks. For investors aiming to buy Polymatech shares, understanding these ratios ensures informed decisions, especially in the unlisted market where transparency may be limited.

In conclusion, investing in Polymatech Electronics unlisted shares can be a lucrative opportunity for those who conduct proper research. By studying the company’s fundamentals, downloading investor documents, and analyzing financial ratios, you can make strategic investment choices and potentially benefit from growth before the company’s IPO.

-

- Sagar Sharma

- 23 posts

Posted in the topic Planning to Buy OYO Unlisted Shares? Here’s What Investors Should Know in the forum SupportJanuary 19, 2026 12:00 AM PSTPlanning to Buy OYO Unlisted Shares? Let’s Discuss

I’ve been seeing a lot of discussion around OYO unlisted shares, so I thought of starting an investors group. Oravel Stays, also known as OYO Rooms, is one of India’s most popular hospitality startups and is poised to make a pre-IPO start. Everyone is waiting for a possible opportunity to buy OYO shares in the unlisted market as 2026 approaches.

If you’re following the unlisted space or already own equity in startups, it is difficult to ignore OYO. However, is the hype justified in terms of fundamentals? The answer is what follows:

About Oravel Stays (OYO Rooms) as a Hospitality Stock

OYO Rooms operates its business as a technology-enabled hotel chain, which partners budget hotels in providing a standardized stay experience in India and abroad. Raising funds as a hospitality stock, the company is unique to hotel businesses as it functions on the asset-light model.

With time, the core focus at OYO has

1. Expanding its worldwide reach

2. Enhancing Unit Economics

3. Moves toward profitability

Costs = Revenues

Such objectives would be relevant for any individual considering unlisted shares of Oravel Stays before a proposed IPO.

OYO Unlisted Shares – Live Price & Market Interest

Current Live Price:

The current prices of unlisted shares in OYO are not like listed stocks because prices fluctuate according to:

1. Seller availability

2. Market sentiment

IPO expectations - Company performance updates Currently, many investors are actively attempting to purchase shares of OYO via brokers that trade pre-IPO stocks. Liquidity, however, is not yet significant, making timing of entry or exit a crucial aspect.

Why Investors are Keen on Pre-IPO OYO Stock

Big Brand Presence

OYO is known as one of the recognizable brands within the hospitality industry. Brand recognition is often one factor that is considered during the IPO evaluation process.

Upside Before the IPO

Buying up unlisted shares prior to the IPO can prove fruitful if OYO achieves a higher valuation in 2026 or afterwards upon listing. This might be the goal of early investors.

Hospitality Recovery Boost

With the increase in travel, the hospitality industry is also gaining renewed attention. That’s spreading positivity about hotels and services like OYO Rooms.

Some of the risks involved when investing in Unlisted Shares of OYO Rooms:

Unpredictable Timing of Initial

No timeline is fixed for its IPO. It may impact its return.

Business Model & Profitability

Despite the progress highlighted, the way to profitability for OYO continues to be closely scrutinized.

Liquidity Challenge

The shares are unlisted, so they are difficult to sell. You may have to hold the shares until an IPO or locate a secondary market buyer.

Anyone Invested in OYO Unlisted Shares?

Would love to hear from the community:

1. Who has invested in the unlisted shares of OYO?

2. What price did you buy at, and what is your investment thesis?

3. Are you targeting the IPO in 2026 or looking for an earlier exit strategy?

Let's make the best use of the thread to discuss insights, risks, and real-life examples regarding Oravel Stays / OYO Rooms unlisted shares. Your views could add to the enlightenment of many!

-

- Sagar Sharma

- 23 posts

Posted in the topic MSEI Pre-IPO Stock: Should You Invest in MSEI Unlisted Shares? in the forum SupportJanuary 15, 2026 11:10 PM PSTThe Metropolitan Stock Exchange of India (MSEI) has been drawing the attention of investors looking into unlisted and pre-IPO shares. With interest in alternative trading platforms and market infrastructure companies, one important question has been on the minds of many investors: Is it a good decision to invest in MSEI unlisted shares before its IPO?

In this forum post, we can talk about the unlisted shares of MSEI, the business potential and risks associated with MSEI, the future price outlook of MSEI shares, and whether it is a good idea to purchase MSEI shares before the IPO.

What Is MSEI? (Metropolitan Stock Exchange of India)

The Metropolitan Stock Exchange of India (MSEI) is notable in India, established to enhance competition in the capital market and offer a transparent trading platform. It provides trading facilities in equity, equity derivatives, currency derivatives, and debt securities.

Although MSEI has not yet reached the same level of trading volumes as NSE or BSE, it is still an important market infrastructure organization. This makes MSEI’s unlisted shares attractive to patient investors.

Key Financials of Metropolitan Stock Exchange of India

P&L Statement

2021

2022

2023

2024

Revenue

10.63

10

9

7

Cost of Material Consumed

16.95

17

23

29

Gross Margins

-59.45

-70

-155.56

-314.29

Change in Inventory

0

0

0

0

Employee Benefit Expenses

22.9

20

19

16

Other Expenses

11.27

8

16

16

EBITDA

-40.49

-35

-49

-54

OPM

-380.9

-350

-544.44

-771.43

Other Income

21.82

15

40

14

Finance Cost

0.83

0.6

0.4

1

D&A

11.17

10

11

6

EBIT

-51.66

-45

-60

-60

EBIT Margins

-485.98

-450

-666.67

-857.14

PBT

-30.67

-31

-20

-48

PBT Margins

-288.52

-310

-222.22

-685.71

Tax

0.41

-1

-1.3

1

PAT

-31.08

-30

-18.7

-49

NPM

-292.38

-300

-207.78

-700

EPS

-0.06

-0.06

-0.04

-0.1

Financial Ratios

2021

2022

2023

2024

Operating Profit Margin

-380.9

-350

-544.44

-771.43

Net Profit Margin

-292.38

-300

-207.78

-700

Earning Per Share (Diluted)

-0.06

-0.06

-0.04

-0.1

Why Investors Are Looking at MSEI Unlisted Shares

1. Pre-IPO Opportunity

Many investors view MSEI unlisted shares as a pre-IPO bet, hoping to benefit if and when MSEI launches its IPO. Early entry into unlisted shares has historically delivered strong returns in select cases.

2. Strategic Importance of Exchanges

Stock exchanges are long-term businesses with high regulatory oversight and entry barriers. Even with low current volumes, an exchange can gain value through reforms, partnerships, or increased market participation.

3. Low Entry Valuation

Compared to listed peers, Metropolitan Stock Exchange unlisted share prices are generally lower, which attracts investors seeking asymmetric risk-reward opportunities.

MSEI Unlisted Share Price Today & Market Activity

The Metropolitan Stock Exchange share price today in the unlisted market depends on demand, supply, financial performance, and future IPO expectations. Prices are usually discovered through private deals and unlisted share platforms rather than public exchanges.

Key points investors discuss on forums:

· Limited liquidity compared to listed stocks

· Prices can remain stagnant for long periods

· Sudden movement possible on IPO-related news

Because of this, MSEI unlisted shares are better suited for investors with a long investment horizon.

Metropolitan Stock Exchange Share Price Target 2025 – Expectations

While it is difficult to give an exact Metropolitan Stock Exchange share price target for 2025, forum discussions generally focus on these factors:

1. Improvement in trading volumes

2. Regulatory support for competition among exchanges

3. Possible strategic investors or mergers

Clear roadmap toward an IPO

If MSEI strengthens its financials and market presence, valuation upside is possible. However, investors should remember that price targets in unlisted shares are speculative and depend heavily on future corporate actions.

Risks of Investing in MSEI Unlisted Stock

1. Low Liquidity

Unlike listed stocks, exiting MSEI unlisted shares can be challenging. Buyers may not always be available.

2. Business Competition

MSEI competes with well-established players like NSE and BSE, which dominate trading volumes.

3. IPO Uncertainty

There is no guaranteed timeline for an MSEI IPO. Investors must be prepared for delays.

4. Limited Public Information

Compared to listed companies, financial disclosures are less frequent, making analysis more difficult.

Who Should Consider Buying MSEI Stock?

Suitable For:

· Long-term investors with high risk tolerance

· Investors experienced in unlisted/pre-IPO stocks

Those building a diversified alternative investment portfolio

Not Ideal For:

· Short-term traders

· Investors needing quick liquidity

· First-time equity investors

How to Buy MSEI Unlisted Shares

Investors usually buy MSEI unlisted shares through:

· Trusted unlisted share brokers

· Pre-IPO investment platforms

Private transactions via investor networks

Always verify:

· Share transfer process

· Demat credit timeline

· Seller credibility

· Applicable taxes and compliance

Final Thoughts: Is MSEI Pre-IPO Stock Worth It?

Investing in MSEI pre-IPO stock is a high-risk, high-patience strategy. The company operates in a critical sector, but execution, volumes, and regulatory dynamics will determine long-term success.

For investors who understand unlisted markets and can stay invested for years, MSEI unlisted shares may offer an interesting speculative opportunity. However, thorough due diligence and realistic expectations are essential before making any decision.

-

- Sagar Sharma

- 23 posts

Posted in the topic SMILE Microfinance Unlisted Shares: Financial Performance & Growth Analysis in the forum SupportJanuary 5, 2026 2:52 AM PSTSMILE Microfinance has emerged as a notable player in India’s microfinance sector, catering primarily to underserved and financially excluded communities. With increasing interest in SMILE Microfinance Unlisted Shares, investors are closely tracking its financial performance, revenue growth, profitability, and earnings metrics to evaluate long-term potential.

This forum post provides a structured overview of SMILE Microfinance Unlisted Shares financials, helping investors understand whether the company’s fundamentals support future growth or a possible IPO journey.

SMILE Microfinance Unlisted Shares Financials

When analyzing SMILE Microfinance Unlisted Shares financials, key indicators such as loan portfolio expansion, asset quality, operating income, and cost efficiency play a vital role. Over recent years, SMILE Microfinance has focused on strengthening its balance sheet while expanding its presence in multiple states.

The company’s lending model emphasizes group-based loans, women empowerment, and rural penetration, which aligns well with India’s growing demand for micro-credit. As a result, SMILE Microfinance Unlisted Shares revenue has shown steady improvement, driven by increased disbursements and better collection efficiency.

From an investor’s point of view, consistency in revenue growth indicates operational stability, which is critical in the microfinance business where margins can be sensitive to economic cycles.

Revenue, Profit & EPS Analysis of SMILE Microfinance

A deeper look at SMILE Microfinance Unlisted Shares revenue reveals that the company has benefited from rising credit demand in semi-urban and rural regions. Improved borrower retention and controlled non-performing assets have supported income growth.

In terms of profitability, SMILE Microfinance Unlisted Shares profit reflects management’s focus on optimizing operational costs and improving yield on advances. While microfinance institutions typically operate on thin margins, disciplined lending and risk management can significantly improve net profit over time.

Another important metric for investors is SMILE Microfinance Unlisted Shares EPS (Earnings Per Share). EPS growth indicates improving shareholder value and reflects how efficiently the company converts profits into returns for investors. Stable or rising EPS often signals a healthy business trajectory, especially in the pre-IPO stage.

Investor Outlook and Growth Potential

The long-term outlook for SMILE Microfinance depends on regulatory stability, portfolio quality, and scalability. With financial inclusion being a priority in India, microfinance companies with strong fundamentals are well-positioned for sustainable growth.

For investors evaluating SMILE Microfinance Unlisted Shares, tracking financial performance trends, revenue sustainability, profit margins, and EPS growth is essential before making any investment decision.