Polymatech Shares Investment – Step-by-Step Guide for Unlisted & Start-Up Stocks

-

January 23, 2026 1:50 AM PST

Investing in Polymatech Electronics Ltd can be a great opportunity for those looking to explore unlisted shares and early-stage start-up investments. Polymatech, renowned for its high-quality electronics components, has been drawing interest from investors eager to enter the market ahead of its public listing. In this guide, we’ll walk you through the key aspects of investing in Polymatech shares, including fundamentals, financials, and how to access investor documents.

Polymatech Electronics Ltd Unlisted Shares

Unlisted shares, like those of Polymatech Electronics, are not yet traded on major stock exchanges. Investing in them allows early investors to potentially benefit from significant growth before the company goes public. While these shares are riskier compared to publicly listed stocks, they often provide higher returns for informed investors. If you’re looking to buy Polymatech shares, you should start by understanding the company’s business model and market potential.

Fundamentals About Polymatech Electronics Ltd

Polymatech Electronics specializes in manufacturing essential electronics components used in a variety of consumer and industrial applications. Before investing, consider these fundamentals:

· Company Profile: Polymatech has a proven track record in electronics manufacturing.

· Product Range: From semiconductors to microelectronics, the company caters to both domestic and international clients.

· Growth Potential: With a rising demand for electronics components globally, Polymatech has strong expansion prospects.

Understanding these fundamentals will help investors make informed decisions about the potential risks and rewards associated with Polymatech Electronics unlisted shares.

Downloads & Investor Documents

When investing in unlisted shares, it’s crucial to review official investor documents. Polymatech provides downloadable resources such as annual reports, financial statements, and business presentations. These documents give insight into the company’s strategy, operational efficiency, and market positioning. Ensure you access the latest files to understand the company’s performance and investment potential.

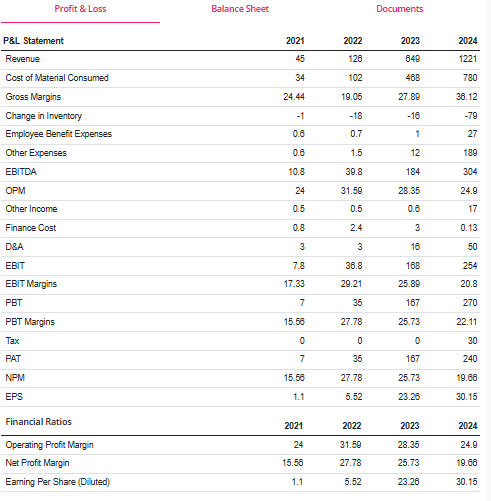

Key Financials of Polymatech Electronics Ltd

Before purchasing shares, evaluate Polymatech’s financial health. Look for:

1. Revenue Trends: Check how the company’s revenue has grown over recent years.

2. Profit Margins: Consistent profitability indicates operational efficiency.

3. Debt Levels: A manageable debt structure reduces financial risk.

Financial Ratios

Analyzing key ratios like P/E ratio, current ratio, and return on equity can help you gauge the company’s performance compared to industry benchmarks. For investors aiming to buy Polymatech shares, understanding these ratios ensures informed decisions, especially in the unlisted market where transparency may be limited.

In conclusion, investing in Polymatech Electronics unlisted shares can be a lucrative opportunity for those who conduct proper research. By studying the company’s fundamentals, downloading investor documents, and analyzing financial ratios, you can make strategic investment choices and potentially benefit from growth before the company’s IPO.